Washington threatens Baghdad with the “nuclear option”: Replace Fayhan and disarm the factions immediately.

Washington threatens Baghdad with the “nuclear option”: Replace Fayhan and disarm the factions immediately.

The British newspaper “Financial Times” revealed that the United States has been pressuring senior Iraqi politicians in recent weeks to form a government that does not include representatives of armed groups supported by Iran, through threats that include economic measures, such as reducing the supply of dollars sent in cash in exchange for Iraq’s oil sales .

The British newspaper “Financial Times” revealed that the United States has been pressuring senior Iraqi politicians in recent weeks to form a government that does not include representatives of armed groups supported by Iran, through threats that include economic measures, such as reducing the supply of dollars sent in cash in exchange for Iraq’s oil sales .

The newspaper quoted informed sources in a report translated by Shafaq News Agency, stating that American officials, during their meeting with prominent Iraqi political leaders tasked with forming the next government in recent weeks, pushed for the presentation of a credible plan to disarm Iranian-backed armed groups quickly .

The report quoted five sources familiar with the talks as saying that US officials threatened punitive measures if this did not happen .

According to three sources, the threats included imposing economic measures, such as reducing the supply of dollars sent in cash in exchange for Iraqi oil sales .

According to the report, tensions with Washington escalated after the election last month of Adnan Faihan, a former member of Asaib Ahl al-Haq, who now leads its political wing, as first deputy speaker of parliament, in a country the report described as being seen as the last stronghold of Iranian influence in the Middle East .

The report quoted one of the sources as saying, “The American embassy completely lost its temper, told us that this was hostile and defiant behavior, and demanded that we replace him .”

The report noted that the coordinating framework that received the largest share of votes is leading the government formation process, and it includes members of several “militias” that the United States classifies as “terrorist” groups. It pointed out that although the fighters of these groups have become less visible now, they enjoy a strong presence in Iraq, while these groups have become part of the state’s security apparatus .

The report also considered Asaib Ahl al-Haq to be among the most influential of these groups, noting that Asaib is trying to reintroduce itself politically, and had a minister in the previous government .

The report indicates that after Asaib Ahl al-Haq came in third in the election results, its political wing, like the wings of other factions, is trying to expand its presence within the government and state institutions, and to deepen the dialogue with Western capitals that are wary of dealing with a group classified by the United States as a terrorist organization .

The report noted that the administration of US President Donald Trump has not yet appointed an ambassador to Baghdad, as is the case in many world capitals that were considered pivotal to US foreign policy. Also, Mark Savaya, Trump’s nominee to serve as special envoy to Iraq, has not yet received congressional approval, while analysts say his influence is limited .

The report also stated that US forces withdrew completely from Iraqi territory under the control of the federal government a few days ago, but will remain in the Kurdistan region .

The report quoted Renad Mansour, a researcher at the British think tank Chatham House, as saying that “Iraq has fallen off the radar of the United States more than at any time in recent decades, yet the Trump administration remains very influential, directly and indirectly, in how the government is formed .”

The report also quoted former US State Department official Victoria Taylor as saying that “the Trump administration’s policy toward Iraq is driven more by Iran than by the relationship with Iraq .”

The report also revealed that since Fayhan’s election to his new position, US officials have frozen all meetings with their allies who voted for him, and have issued a list of names of MPs they do not want to have in the government .

In addition to demanding that Faihan be replaced from his position as First Deputy Speaker of Parliament, US officials are also calling for plans to be accelerated to disarm Shiite armed groups .

The report noted that Savaya had said in recent social media posts that the US Treasury Department would be reviewing transactions of Iraqi entities suspected of having financial links to “terrorist activities “.

According to three informed sources, Washington threatened to cut off dollar supplies to Iraq if Baghdad rejected American demands, a move one of these sources described as the “nuclear option “.

The report explained that Iraq’s economy has long relied on a special arrangement reached after the US invasion of Iraq, whereby since 2003, Washington has been sending billions of dollars in cash shipments annually to Baghdad via monthly flights, funds originating from Iraqi oil sales, the proceeds of which are deposited into Iraq’s account at the US Federal Reserve .

The report stated that if Washington were to cut off these dollar supplies again, Iraqis fear instability and an economic crisis .

The report quoted one of these sources as saying, “They told us that if we do not meet their demands, America will not be willing to help Iraq .”

According to the report, these threats, in addition to fears of possible military action by the United States and Israel, contributed to pushing Iraqi politicians to comply with some American demands .

The report also quoted five people familiar with the talks as saying that the Coordination Framework and Asaib Ahl al-Haq had expressed their willingness to replace Fayhan, with one of these sources saying that “it is better to compromise on this point than to compromise on another .”

According to the British report, the issue of disarmament remains the most sensitive issue, as the “militias” have long resisted pressure to disarm, considering that their weapons are still necessary to defend Iraq .

The report quoted a source as saying that the coordinating framework, including the main militias backed by Tehran, offered to announce a phased disarmament plan over two years after the formation of the government, hoping that the issue would “lose momentum” before its implementation. However, the report said that Washington demanded immediate action .

The report quoted Taylor as saying, “These demands are all in line with this administration’s goals,” adding, “Given Iran’s weakness and the militias’ fear of Trump and what he might do, why shouldn’t the United States try to exert maximum pressure? ”

Shafaq.com

AFP: All those handed over to Iraq from ISIS fighters are “emirs in the organization”

AFP: All those handed over to Iraq from ISIS fighters are “emirs in the organization”

Two security officials revealed on Friday that the first batch of ISIS detainees received by Iraq included individuals holding European citizenship who were prominent leaders in the extremist organization .

Two security officials revealed on Friday that the first batch of ISIS detainees received by Iraq included individuals holding European citizenship who were prominent leaders in the extremist organization .

The two officials told AFP, commenting on Baghdad receiving last Wednesday the first batch of ISIS detainees as part of the US operation to transfer them from Syria, that it includes ISIS leaders and “the most heinous criminals of different nationalities, Europeans, Asians, Arabs and Iraqis .”

The two officials also noted that the group includes “85 Iraqis and 65 foreigners, including Europeans, Sudanese, Somalis and people from the Caucasus countries, all of whom participated in ISIS operations in Iraq, and all of whom are at the level of emirs in the organization .”

Meanwhile, the European Union said reports of foreign fighters from the Islamic State group escaping from detention in Syria were a source of “grave concern,” adding that it was monitoring the transfer of detainees to Iraq .

European Union spokesman Anwar Al-Anouni said that the recent potential escapes of ISIS detainees amid clashes are of grave concern .

He added, “We are closely monitoring the situation, including the transfer of remaining detained fighters to Iraq, including foreign terrorist fighters .”

Last Wednesday, the US Central Command (CENTCOM) announced the start of transferring up to 7,000 ISIS detainees held in Syria to “Iraqi-controlled facilities,” in a move aimed at “ensuring that terrorists remain in secure detention facilities .”

She said that 150 detainees were transferred from a prison in Hasakah province (northeast Syria), while Baghdad confirmed receiving the first batch, which includes Iraqis and foreigners .

Shafaq.com

Ukraine reaches agreement with the United States on “post-war guarantees”

Ukraine reaches agreement with the United States on “post-war guarantees”

On Thursday evening, Ukraine reached an agreement with the United States on what it described as post-war guarantees, according to Ukrainian President Volodymyr Zelensky in Davos, Switzerland.

On Thursday evening, Ukraine reached an agreement with the United States on what it described as post-war guarantees, according to Ukrainian President Volodymyr Zelensky in Davos, Switzerland.

Zelensky confirmed in press statements following his meeting with his American counterpart Donald Trump in the Swiss city that they had reached an agreement on post-war American security guarantees, a key issue in developing a plan to end the war with Russia.

Zelensky told reporters that the issue of security guarantees had been “done”.

The Ukrainian president added, “Both parties, the two presidents, must sign the document, and then it will be submitted to the two national parliaments.”

However, Zelensky pointed out that the issue of the territories claimed by Moscow in eastern Ukraine “has not yet been resolved” in the negotiations to end the war.

He explained, “Everything revolves around the eastern part of our country, everything revolves around the land, this is the problem that we have not yet solved.”

US President Donald Trump announced earlier on Thursday that his meeting with his Ukrainian counterpart Volodymyr Zelensky was ” very good , ” explaining that his message to Russian President Vladimir Putin was that ” the war in Ukraine must end . ”

Trump spoke briefly to reporters after leaving the meeting with Zelensky, which the White House said lasted about an hour.

Shafaq.com

Sudani receives Trump’s envoy in Baghdad… Numerous issues on the table

Sudani receives Trump’s envoy in Baghdad… Numerous issues on the table

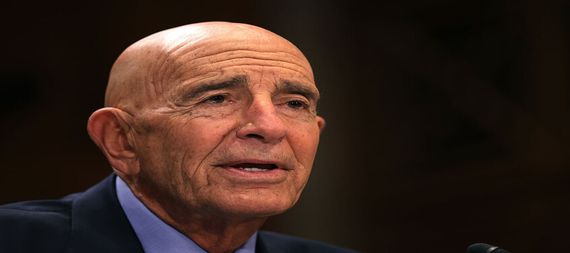

Outgoing Prime Minister Mohammed Shia al-Sudani stressed to US President’s envoy to Syria Thomas Barak on Thursday evening the importance of Damascus’s security for Baghdad and the region, while Barak expressed his country’s appreciation for the Iraqi position regarding the recent developments in Syria .

Outgoing Prime Minister Mohammed Shia al-Sudani stressed to US President’s envoy to Syria Thomas Barak on Thursday evening the importance of Damascus’s security for Baghdad and the region, while Barak expressed his country’s appreciation for the Iraqi position regarding the recent developments in Syria .

This came during Al-Sudani’s reception of Barak in Baghdad, where they discussed the situation in the region and developments in the Syrian arena, according to a statement received by Shafaq News Agency .

According to the statement, the Prime Minister stressed the importance of security in Syria for Iraq and the region, and the need for cooperation to establish stability and ensure the unity of Syrian territory .

Al-Sudani also pointed out, according to the statement, “the constructive partnership between Iraq and the United States in the field of combating terrorism, establishing the foundations of economic cooperation, sustainable development, and supporting bilateral and regional efforts for prosperity in Iraq and the region .”

The statement quoted Barak as conveying to the Prime Minister “the appreciation of the American President for the Iraqi government’s efforts in supporting stability in the region and managing Iraq’s positions during this sensitive period .”

The statement added that the US envoy “praised the steps taken by the Sudanese government and the performance of the Iraqi security forces in combating terrorism, and Iraq’s openness to international investments and the establishment of economic interdependence, which constituted an important factor for stability .”

Following the meeting, the US envoy posted a message on the “X” platform, which read: “On behalf of the US President and Secretary of State Rubio, we are honored to extend our sincere thanks to the Iraqi government for its outstanding leadership within the international coalition to defeat ISIS, and for its continued willingness to contribute to protecting the international community from the ongoing threat posed by ISIS detainees .”

He added that “Iraq’s vital contributions to promoting stability in Syria, and in the entire region, are indispensable, reflecting a firm commitment to collective security and paving the way for a more peaceful, prosperous and united future for all our neighbors .”

Shafaq.com

During the year, China’s exports to Iraq exceeded $17 billion, an increase of 57%.

During the year, China’s exports to Iraq exceeded $17 billion, an increase of 57%.

The Iraq Future Foundation for Economic Studies and Consultations announced on Friday that China’s exports to Iraq exceeded $17 billion last year, warning of a financial deficit in the next few years due to rising imports for the country.

The Iraq Future Foundation for Economic Studies and Consultations announced on Friday that China’s exports to Iraq exceeded $17 billion last year, warning of a financial deficit in the next few years due to rising imports for the country.

The head of the organization, economic expert Manar Al-Obaidi, explained in a report published today that direct Chinese exports to Iraq reached more than $17 billion in 2025, an increase of 57% compared to 2020, when they were only $10 billion, according to official data issued by the Chinese Customs Authority.

He added that, in contrast, Iraqi oil exports have decreased to $34 billion. Although Iraq still achieves a trade surplus with China, the rise in imports compared to the decline in the value of exports indicates that the trade balance may turn into a deficit by 2029 unless exports are increased and diversified, and an attempt is made to localize the manufacturing of some goods that could keep the trade balance in Iraq’s favor.

Shafaq.com

Washington welcomes Iraq’s initiative regarding detained ISIS terrorists

Washington welcomes Iraq’s initiative regarding detained ISIS terrorists

The United States welcomed on Thursday Iraq’s initiative to detain members of the ISIS terrorist organization in secure facilities.

The United States welcomed on Thursday Iraq’s initiative to detain members of the ISIS terrorist organization in secure facilities.

Reuters quoted US Secretary of State Marco Rubio as saying, “We welcome Iraq’s initiative to detain ISIS terrorists in secure facilities on its territory.”

He added, “Iraq stands on the front lines in confronting the threat of ISIS to all countries,” adding, “We urge countries to assume their responsibilities and repatriate their citizens affiliated with ISIS to face justice.”

Iraq had agreed to receive ISIS terrorists of Iraqi and other nationalities who were detained in prisons that were under the control of the Syrian Democratic Forces, in cooperation with the international coalition to fight the organization.

It is worth noting that the US Central Command announced Wednesday, the start of transferring ISIS terrorist detainees from Syria to Iraq, adding, “We are coordinating with our partners in the region and the Iraqi government and appreciate their role in ensuring the defeat of ISIS.”

Burathanews.com

The US President’s envoy to Syria praises Iraq’s contributions to promoting stability in the region.

The US President’s envoy to Syria praises Iraq’s contributions to promoting stability in the region.

The US President’s Special Envoy to Syria, Thomas Barak, praised Iraq’s contributions to promoting stability in the region, describing them as “indispensable”.

The US President’s Special Envoy to Syria, Thomas Barak, praised Iraq’s contributions to promoting stability in the region, describing them as “indispensable”.

Barak said in a post on the X platform: “We are very honored to thank the Iraqi government for its exceptional leadership within the international coalition to defeat ISIS, and for its unwavering willingness to help protect the international community from the ongoing threat posed by ISIS detainees.”

He added: “Iraq’s vital contributions to promoting stability in Syria and the wider region are indispensable. They reflect a deep commitment to collective security and pave the way for a more peaceful, prosperous and united future for all our common neighbors.”

Burathanews.com

The banking sector and the new public

The banking sector and the new public

The past year, 2025, witnessed tireless activity at various levels in the pursuit of achieving the desired banking reform in Iraq.

The past year, 2025, witnessed tireless activity at various levels in the pursuit of achieving the desired banking reform in Iraq.

On the one hand, the outgoing government made strenuous efforts to reform the state-owned banks, which included merging some banks and making the decision to split Al-Rafidain Bank into two banks. These measures were described as being part of the reform of the state-owned banking sector.

On the other hand, the Central Bank of Iraq, as the supervisory and regulatory body for the work of private (national) banks, played a pivotal role in advancing the reform of this sector, by taking important steps during 2025, the most prominent of which was bringing in the global company “Oliver Wyman”, which is one of the consulting companies specializing in the development of banking and financial systems.

This contract aims to elevate the private banking sector to meet international standards, especially since Iraq is about to enter a phase of developmental and reconstruction renaissance that requires a robust banking sector capable of meeting the needs of international companies wishing to invest in Iraq, after the wars and crises that the country has gone through that have deeply affected its economic structure.

Oliver Wyman established strict conditions and clear requirements for achieving banking reform, obligating banks to comply and emphasizing that those lagging behind or failing to comply could be forced out of the banking sector. These conditions included: increasing bank capital, encouraging bank mergers, and adhering to international standards for governance, solvency, and risk management.

According to the available data, most banks have responded to these requirements and agreed to bear the costs of consultations and repairs.

This raises a fundamental question commensurate with the scale of this response:

After the banks have fulfilled their obligations, what rights and facilities should they receive to enable them to provide banking services that meet the standards of international banks?

Banking experts believe that successful banking reform is a reciprocal process. After banks commit to the new standards, there is an urgent need for an incentive package to help them conduct their banking activities efficiently, especially since a large portion of banks are still subject to various sanctions.

These stimulus packages include financial and funding support, technical assistance and institutional capacity building, regulatory flexibility and a phased approach to implementing requirements, infrastructure and technological system reforms, and opportunities for growth and regional and international partnerships. The success of banking reform depends not only on enforcement but also on integrating obligations with rights and building a banking environment capable of supporting comprehensive economic development in Iraq.

Finally, reforming the banking sector in Iraq cannot be measured solely by the number of regulations or the stringency of the conditions, but rather by its ability to become a genuine engine for economic development. Banks that have responded to the reform requirements and complied with international standards, in turn, need a supportive regulatory environment and practical incentives that enable them to fulfill their natural role in financing, investment, and driving economic growth. Successful banking reform is a balanced partnership between the regulatory authority and the banks, based on the exchange of obligations and rights, a phased implementation, and addressing structural challenges, foremost among them sanctions, weak infrastructure, and limited financing tools. Without this, reform could transform from an opportunity for advancement into a burden that hinders the sector’s effectiveness.

With the start of a new year, the opportunity remains to build a modern, robust Iraqi banking sector that is integrated into the global financial system and capable of meeting the requirements of reconstruction and sustainable development, provided that the reform process is completed with a comprehensive vision that balances discipline and empowerment, and oversight and incentives, in a way that serves the national economy and enhances confidence in the banking system.

Alsabaah.iq

Sudani: We are in contact with Iran and America to find a platform for dialogue between them in Baghdad.

Sudani: We are in contact with Iran and America to find a platform for dialogue between them in Baghdad.

Outgoing Prime Minister Mohammed Shia al-Sudani confirmed on Tuesday that Iraq is in contact with Iran and America to find a platform for dialogue between them in Baghdad, noting that the principle of restricting weapons to the state enjoys national consensus and has now become acceptable.

Outgoing Prime Minister Mohammed Shia al-Sudani confirmed on Tuesday that Iraq is in contact with Iran and America to find a platform for dialogue between them in Baghdad, noting that the principle of restricting weapons to the state enjoys national consensus and has now become acceptable.

The Prime Minister’s Media Office stated in a statement received by Shafaq News Agency that Al-Sudani received, on Tuesday, the ambassadors of the European Union countries accredited to Iraq.

According to the statement, Al-Sudani said that the 2025 elections represented a turning point in the history of the political process in Iraq, due to the integrity and smoothness of its conduct, and the size of the active participation, which indicated the return of some of the people’s confidence in the political process and the democratic system based on the peaceful transfer of power.

He explained that the government has carried out important structural reforms in various sectors over the past three years, and has been able to attract Arab and foreign investments and provide an attractive environment for the work of the local and foreign private sector, indicating that the principle of restricting weapons to the state enjoys national consensus and has become acceptable and everyone accepts it, and the talk now is about the timing and mechanism, which represents a clear positive development.

Al-Sudani pointed out that the world is living in a state of instability and that there is an erosion of the international system based on laws and rules since World War II, adding that the return of the logic of force and wars and the imposition of the will of one party on others is very dangerous, and we are witnessing it today on a wide scale in more than one place.

Al-Sudani continued, saying that “the current internal and regional challenges call for the formation of a strong government capable of making decisions away from any internal or external dictates,” explaining that “the priority now is to prevent institutional decline in this complex regional and international situation.”

He added that “the Reconstruction and Development Coalition will be a key factor in the political landscape of the next phase, given the popular mandate it has received,” adding: “We are in contact with the Islamic Republic of Iran and the American administration in order to find a dialogue platform in Baghdad between Washington and Tehran.”

Al-Sudani pointed out that his country has made great strides in its relationship with the international coalition, as it has taken full control of the Ain al-Asad base, and the number of coalition advisors in Baghdad has been significantly reduced, with the mission at the Harir base in Erbil to be fully completed in September 2026,” stressing that “Iraq will remain an active partner in the international coalition to fight ISIS, and our coordination continues in the fight against ISIS.”

He also stressed that Syria is experiencing an unstable situation, and we are concerned about the growing presence of ISIS elements and other extremist groups currently inside prisons, pointing to the importance of a transparent political process in Syria that includes everyone, and real steps and procedures to reassure all Syrian components by rejecting terrorism and extremism and respecting human rights.

Al-Sudani also said that “Iraq views Syria and its stability as a very important national and regional priority,” noting that “a stable and unified Syria in which all its components coexist in peace is a fundamental guarantee for the security of the region, and that Iraqi society is cohesive, our security forces are ready and able to impose security, and our borders are secure.”

According to the Prime Minister, the border security measures were taken two years ago based on an advanced reading of events in Syria, indicating that security in Syria requires collective responsibility and real international cooperation, and our position is firm in the immediate cessation of bloodshed in Gaza, stopping the violations in Lebanon, and ending the suffering of the Palestinian people.

Shafaq.com