After 21 years of the dollar auction… Iraq is close to closing the window amid reassurances and warnings

Iraq is approaching the end of the closure of the dollar selling window at the Central Bank – which has been controversial – over the past two decades.

Iraq is approaching the end of the closure of the dollar selling window at the Central Bank – which has been controversial – over the past two decades.

The Central Bank’s management plans to gradually cancel the dollar auction during the year 2024, leading to its complete cancellation by the end of the year, and to maintain it for audit and statistical purposes, in an effort to enable Iraqi banks to establish and establish solid banking relationships with the global and regional banking sector in order to achieve the sobriety of the Iraqi banking sector and full commitments according to international standards and requirements.

Iraq relies on the platform for selling currency directly to local banks and companies, which was previously known as the daily dollar auction, as one of the mechanisms for preserving the value of the Iraqi dinar and combating speculative operations in the parallel market.

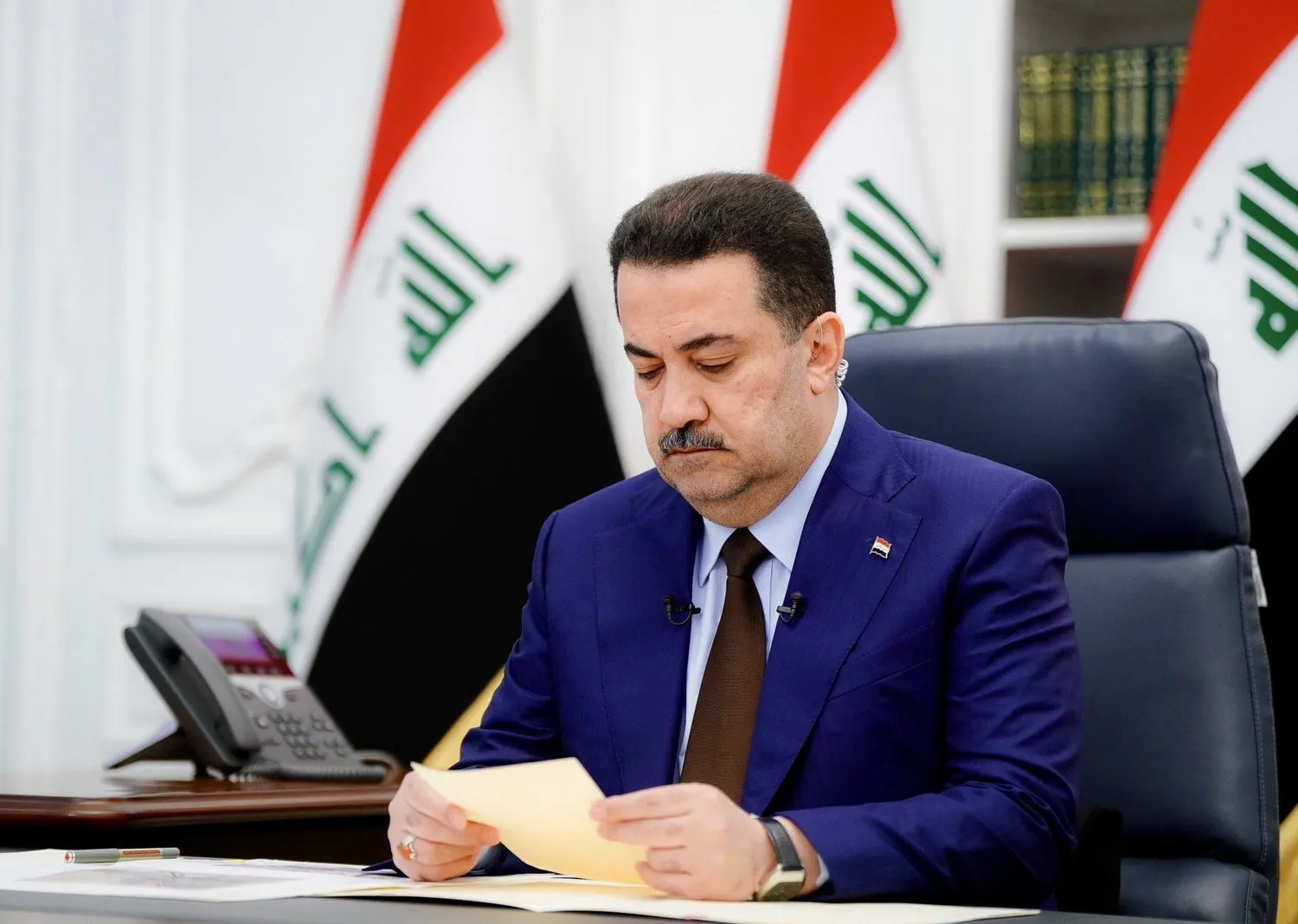

The visit of Prime Minister Muhammad Shia Al-Sudani to Washington provided a strong impetus in closing the Central Bank window and moving towards direct commercial banking transactions.

According to the joint statement of the Iraqi-American discussions headed by Al-Sudani and President Joe Biden, the latter “discussed Iraq’s advanced efforts to reform the financial and banking sectors, which help link Iraq to the international economy and increase trade while protecting the Iraqi people from the harmful effects of corruption and money laundering, and what was achieved during the years 2023 and 2024.” “With banks in Iraq expanding (correspondent relationships) with international financial institutions to enable trade financing.”

The statement notes that “the majority of trade financing operations are now carried out through these channels.”

Iraq and the United States pledged their commitment to “strengthen their cooperation to achieve greater transparency and cooperation against money laundering, terrorist financing, fraud, corruption, and sanctioned activities that could undermine the integrity of the financial systems in both countries.”

The two countries expressed their commitment “to support the Central Bank of Iraq in ending the electronic auction platform for international financial transfers by the end of 2024, through direct dealing between licensed banks in Iraq and approved global correspondent banks, to achieve this transformation that will connect Iraqis and Iraqi companies to the international economic system.”

In this regard, the financial advisor to the Prime Minister, Mazhar Muhammad Saleh, confirmed to {Al-Furat News} that the agreement of Iraq and the United States to end the electronic platform of the Central Bank of Iraq for selling the dollar at the official price means the cancellation and end of the foreign currency window that was established since 2003.

Saleh said, “It is not One of the functions of the central banks in the world is to carry out financing operations for foreign trade in their countries. Central banks are banks that work on monetary stability as they are banks that issue the national currency, as well as the function of supervising banking activity and ensuring its safety and stability.

He added, “But Iraq’s rentier conditions, and because of the foreign cash flows entering the country through which foreign exchange reserves originating from oil export revenues are created, such a necessity was imposed in financing foreign trade for the private sector through the establishment of the foreign currency window (auction) a month ago.”

October 2003, during which this window played a dual role in the work of the Central Bank of Iraq’s monetary policy, both in controlling local liquidity levels (monetary sterilization) and the so-called open market process, which requires exchanging the dinar for the dollar for the purposes of external transfer related to financing domestic trade. In addition to achieving the goal of controlling the stability of the Iraqi dinar exchange rate at the same time.”

Saleh noted that, “In order to return to the principles of financing trade through the commercial banks themselves directly by opening documentary credits with correspondent banks abroad, their external accounts opened with their correspondents from foreign banks will be fed with their requests for foreign currency through the Central Bank of Iraq in order to enable them to… Opening documentary credits to finance foreign trade to the private sector in a more transparent manner and at the same time subject to international compliance rules through the role that these international banks with high credit ratings will play.”

He explained, “What practically means canceling the auction or the foreign currency window that was established in October 2003 and its expected lifespan was two years, but unfortunately it continued for more than twenty years!”

He continued, “Based on the above, the efficiency of using foreign currency will undoubtedly increase through continued control of local liquidity levels and the imposition of stability in the Iraqi dinar exchange rate, but in a different way that is consistent with the new banking applications fully approved in the year 2024.”

On the other hand, specialists warn against stopping the platform for selling the dollar, especially with the continuing delay in Iraqi banking systems and the failure to activate Iraqi commercial banks’ dealings with international banks, because this will lead to a monetary disaster that will ravage the Iraqi market.

But Abdul Rahman Al-Mashhadani, the economic expert, downplayed the seriousness of these warnings. He told {Al-Furat News}, “The subject of the agreement with the American side does not mean that the currency auction will end, but rather it will return to work according to the old mechanism for enhancing balances. However, the Iraqi banks that will be entitled to external transfer must be linked to solid correspondent banks.”

He stated, “The mechanism will not change. Rather, the Iraqi Bank will be transformed into a correspondent bank, and its balance will be enhanced by the Central Bank.”

Al-Mashhadani ruled out, “The exchange rates in the markets were affected because they are not directly related to these matters. Rather, the decline and rise are due to trade with the sanctioned countries, for which there are no solutions because they are financed from the parallel market, and without solving them, there cannot be stability in exchange rates.”

Another economic expert believes it is necessary to tighten control to prevent the “leakage” of the dollar.

Bassem Jamil Antoine told {Al-Furat News}, “When the dollar crisis is addressed scientifically, economically, and financially, there will be a floatation of the currency through supply and demand, so that the citizen will obtain the quantities of dollars to the extent he wants, as the scarcity is now in the dinar and not in the dollar from which it is received.” On a daily basis, no less than 300 to 400 million dollars.”

He stated, “This process goes to the financial stability of the country, as the import is through correspondent banks that transfer money amounts, and this process requires follow-up, time, and knowing the fate of the money.”

Antoine explained that “the process of floating the currency must be under conditions, and Iraq differs from other countries because its financial imports in dollars are very large, and there must be control over the process, stopping the leakage of the dollar, and not leaving it floating under the freedom of speculators. There will be difficulty in achieving balance, and this matter needs a rule.” Productivity away from imports, creating job opportunities and ending unemployment, and this process requires more time and strict oversight to stop the currency auction, which has greatly destroyed the country,” he said.

Alforatnews.iq

A member of the delegation accompanying the Prime Minister, Aed Al-Hilali, suggested that things would go towards complete control of the dollar exchange rate and a clear and rapid decline in the coming days.

A member of the delegation accompanying the Prime Minister, Aed Al-Hilali, suggested that things would go towards complete control of the dollar exchange rate and a clear and rapid decline in the coming days.

Shafaq News / The Central Bank of Iraq warned, on Wednesday, of fake pages on social media sites with the names of companies licensed by the bank luring citizens with fake dollar purchases.

Shafaq News / The Central Bank of Iraq warned, on Wednesday, of fake pages on social media sites with the names of companies licensed by the bank luring citizens with fake dollar purchases. Shafaq News / The Parliamentary Finance Committee pointed out, on Wednesday, the problem of the lack of cash “Iraqi dinar,” calling for “confining the dinar to the state.”

Shafaq News / The Parliamentary Finance Committee pointed out, on Wednesday, the problem of the lack of cash “Iraqi dinar,” calling for “confining the dinar to the state.”

Prime Minister Muhammad Shiaa Al-Sudani received, at his residence in Washington, at dawn on Tuesday, US Treasury Under Secretary Wali Adeyemo, and the delegation accompanying him, in the presence of the Governor of the Central Bank of Iraq.

Prime Minister Muhammad Shiaa Al-Sudani received, at his residence in Washington, at dawn on Tuesday, US Treasury Under Secretary Wali Adeyemo, and the delegation accompanying him, in the presence of the Governor of the Central Bank of Iraq. Iraq is approaching the end of the closure of the dollar selling window at the Central Bank – which has been controversial – over the past two decades.

Iraq is approaching the end of the closure of the dollar selling window at the Central Bank – which has been controversial – over the past two decades. A government source revealed, today, Tuesday, that Prime Minister Muhammad Shiaa Al-Sudani issued a set of measures and steps to revitalize the private banking sector, while directing a study of the possibility of strengthening the needs of private bank branches abroad in foreign currency.

A government source revealed, today, Tuesday, that Prime Minister Muhammad Shiaa Al-Sudani issued a set of measures and steps to revitalize the private banking sector, while directing a study of the possibility of strengthening the needs of private bank branches abroad in foreign currency.